Harvest Fund

Who are we?

The Harvest Funds, established by Endeavor SA, and modelled off Endeavor Global’s successful Catalyst Funds, is a ‘first of its kind in Africa’ rules-based co-investment fund investing in local Endeavor Entrepreneurs.

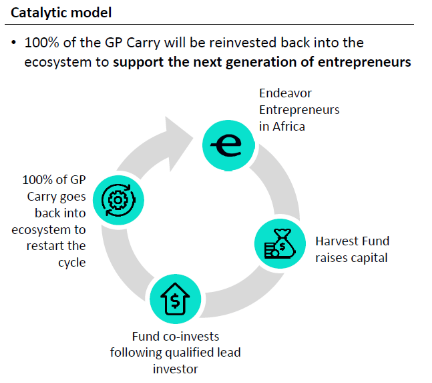

Harvest co-invests alongside credible lead investors and leverages Endeavor’s rigorous selection process – one that selects market-leading, founder-led companies with exceptionally strong local & global growth, scalable IP, a pay-it-forward mindset, and robust returns. The Harvest Funds are structured such that 100% of the GP’s carry will be reinvested back into the ecosystem.

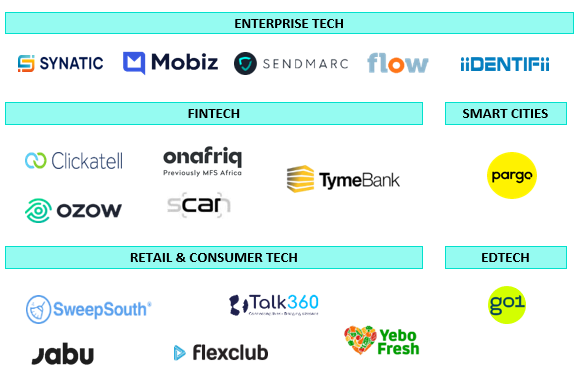

The growing portfolio of Harvest Funds is outlined below

Harvest Fund III, capital raising in progress

- Harvest Fund III follows in the footsteps of Harvest Fund II, is a rules-based co-investment fund.

- Expanded Pan African focus, with up to 15% allocation to Endeavor Entrepreneurs from other Endeavor Africa Offices (Egypt, Kenya, Nigeria)

- Targeting a first close in early 2024.

Harvest Fund II, est. 2021

- Harvest Fund II, with total fund size of R190m, is a rules-based co-investment fund.

- Focuses on majority Endeavor Entrepreneurs from the Endeavor South Africa portfolio, those that have passed both the local and international selection panels.

- Allocates up to 25% to earlier stage, emerging Endeavor Entrepreneurs with global scalability.

- 19 Deals in 17 investee companies to date, almost fully deployed.

Harvest Investment Team

Capital Markets Lead

CFO & COO

Senior Advisor

Managing Director